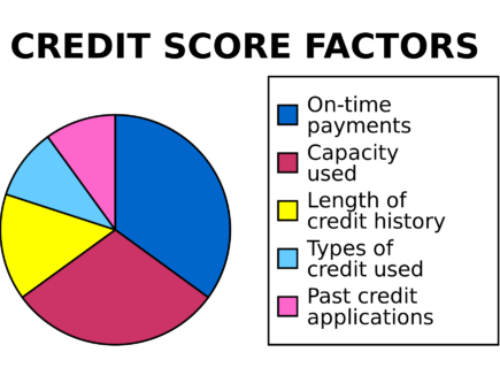

Utilization is a fancy version of the word “USAGE”. This represents one of the most important categories in calculating your credit score — but it’s commonly misunderstood. Here we will go through how to calculate your credit utilization. Watch out for future articles where we will use more advanced examples and strategies with credit utilization in mind.

Credit utilization represents how much of your available credit you use in the form of a percentage.

Your “TOTAL CREDIT BALANCE” represents how much spending you have already spent on credit.

Your “TOTAL CREDIT LIMIT” represents how much you’re allowed to spend without being penalized.

The “CREDIT UTILIZATION” rate is simply equal to:

(TOTAL CREDIT BALANCE) / (TOTAL CREDIT LIMIT)

__________________

For example, let’s say you currently have one credit card with an outstanding balance of $250. That means you owe $250 to the credit card company. This figure is considered your BALANCE.

Now let’s say that your credit card limit is $1,000. This means that the credit card company has approved you for $1,000 worth of potential spending on your credit card.

By using the equation mentioned above you would be able to calculate your credit utilization. Here it is written out below:

Total Credit Card Balance = $250

Total Credit Card Limit = $1,000

Credit Utilization = (TOTAL CREDIT BALANCE) / (TOTAL CREDIT LIMIT)

Credit Utilization = ($250) / ($1,000)

Credit Utilization = 0.25 = 25%

In this case, your credit utilization would be equal to 25%. In other words you have used up 25% of your current credit spending power.

Try this calculation out with your own credit cards to determine your total utilization rate. Look for future articles to see more in-depth examples and strategies.

Leave A Comment