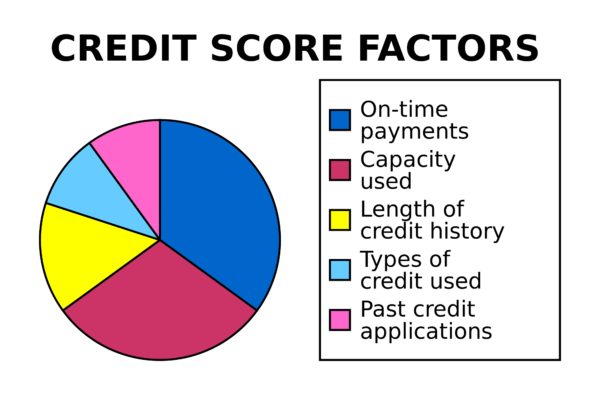

Some of the major factors that affect your credit score are pretty obvious, while others not so much. The key to improving your score is to thoroughly understand the ins and outs of each major factor so you learn how to play the system.

We’ll dive into major factors in-depth in other articles, but for now make sure you take note of these five major factors:

Payment History

The key to this category involves making your payments on-time and not having any delinquent marks. These bad marks in the “Payment History” category include, but are not limited to, missed or late payments, bankruptcies, collection lawsuits, etc.

Credit Card Utilization

Utilization is a fancy version of the word “USAGE”. This category is one of the most important factors, and is commonly misunderstood. It represents how much of your available credit you use in the form of a percentage. Your “TOTAL CREDIT BALANCE” represents how much spending you have already spent on credit. Your “TOTAL CREDIT LIMIT” represents how much you’re allowed to spend without being penalized. The “CREDIT UTILIZATION” rate is simply equal to:

(TOTAL CREDIT BALANCE) ÷ (TOTAL CREDIT LIMIT)

We’ll explore this category deeply in later articles, as this is where I’ve learned is one of the best ways to play the system.

Age of Credit History

This category just represents how long you have had your current credit card and/or loan accounts open. Generally, the longer the better — which is why it is usually a good idea to keep accounts open if possible even if you don’t use them.

Total Accounts

This category represents the total number of credit related accounts you have open. Again, we’ll explore this in-depth later. Common sense would probably tell you that less is better, BUT ACTUALLY more is better — up to an extent.

Hard Inquiries

A hard inquiry is a “mark” on your credit that occurs whenever you apply for credit (personal loans, mortgages, credit cards, etc). You’re going to run into hard inquiries when you’re adding accounts, but the key is to the timing of adding these accounts and applying for credit you are likely to be approved for. We’ll explore the right balance later on.

This is a quick, basic overview of the major items that affect your credit score. If you have any questions, make sure to comment them below!

Leave A Comment